Also Read: Our blog on Raw material pricing dynamics: Taking a bird’s eye view using causal loop diagram. The blog provides the basic understanding on how raw material and commodity prices alter and subsequently how industries get affected due to disruptions such as war.

Global crude oil prices cross $100 per barrel mark for the first time since 2014, shortage of palladium and neon exacerbates semiconductor shortage, prices of soaps and plastics will rise and many more yet to come. All of these impacts are due to the Russia-Ukraine war. The Russia-Ukraine war has created a supply shortage across various commodities and will affect industries and common people across the world.

Impact on steel market

India imports about 56 million tonnes (MT) of coking coal worth around Rs. 72000 crore annually. Out of this about 45 MT is imported from Australia alone and remaining from South Africa, Canada and the US. Coking coal is a raw material used in the production of steel. All the nations mentioned above are geographically far away from India.

To diversify its supply sources, the Ministry of Steel of Republic of India signed a Memorandum of Understanding (MoU) with the Ministry of Energy of Russian Federation in July 2021 for cooperation regarding coking coal. This MoU will reduce dependence on select countries. Also, as Russia is geographically closer to India, per-tonne cost of steel production can be reduced. Due to economic sanctions imposed on Russia, India will face difficulty in diversifying its supply sources.

Impact on the Aluminum commodity market

Analyst at domestic brokerage firm Motilal Oswal believes that the sanctions on Russia will impact the prices of aluminum positively. Russia accounted for 9-10% of global aluminum exports in 2020. The sanctions on RUSAL will intensify the already existing supply crunch in the market. India is a net exporter of aluminum and companies such as Hindalco, NALCO, and Vedanta will benefit from the elevated aluminum prices. These companies can fill the supply gaps that will be created in the market.

Impact due to rise in crude oil prices

Global crude oil prices breached $100 per barrel for the first time since 2014 after Russia launched an attack on Ukraine. India is a major importer of oil and sources over 80% of its needs through imports. India imports only 2% of its crude oil from Russia making it less vulnerable to supply disruptions. However, the country is susceptible to the global price rise.

Sanctions on Russia by the US and the EU will lead to a global supply shortage of oil as Russia is the third largest oil producer. The rise in prices of crude oil will lead to rise in prices of the products that are derived from crude oil. Examples include petrol, diesel, products made from petroleum like soaps, plastics, etc.

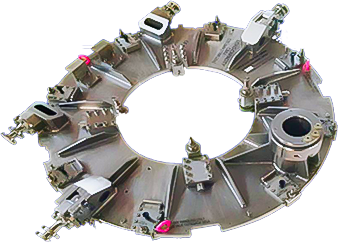

Impact on auto and semiconductor industry

.jpg)

Russia and Ukraine, both are suppliers of key raw materials used in production of semiconductor chips i.e. palladium and neon. Russia controls as much as 44% of global palladium supplies and Ukraine produces 70% of global supply of neon. This war will lead to a shortage of chip supply for auto industries and could impact their production.

Chips are used in LED headlights, infotainment systems, air conditioning systems, airbags, seat-belt tensioner, ABS and stabilization systems. All of these systems execute their functions with the help of chips. Also, palladium is used in catalytic converters in car exhausts for converting toxic elements into less harmful carbon-dioxide and water vapor.

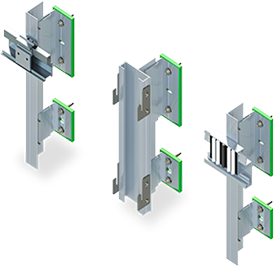

Work with Karkhana.io

Commodity prices are not in our control but you can bring efficiency to your parts sourcing by hiring a digital global part-sourcing vendor. Karkhana.io can help you get the right parts at in proximity for the best value. Get in touch with us to know more.

Our strong client base is present across India, encompassing cities such as Bangalore, Chennai, Delhi, Mumbai, Pune, and Hyderabad. We cater to our clients with seamless manufacturing solutions across industries like Aerospace, Automation, Automobile, Defence, Drone, Energy, EVs, FMCG, General Engineering, Medical, Oil & Gas, Pharma, and Robotics.

Let us help you reach the optimal outcome for all your manufacturing requirements. To get started, simply email Alay Shah on alay@karkhana.io with your requirements or fill out the form below.