Since the beginning of this century, the contribution of the manufacturing sector to the GDP has hovered around 15-17%. Successive governments have launched programs to propel the sector and make it India’s engine of growth, and generate jobs.

Central government programs such as the National Manufacturing Policy, announced in 2011, and the Make In India program, announced in 2014, have been designed to attract investments in the manufacturing sector. Through policy initiatives and forward-looking government-industry collaboration, the government seeks to improve India’s competitiveness and ease of doing business. Moreover, the Make In India program seeks to push the sector’s contribution to 25% of the GDP.1 India’s imports are characterized by value-added products (non-petroleum category), signifying that manufacturing in India needs to move-up the value chain.2

Despite the policies, the initial data from 2014 to 2020 suggests that manufacturing’s contribution to GDP has declined while the absolute output increased from 2014 and peaked in 2018.

COVID-19 Pandemic: Furthering the Imperative for a Robust Manufacturing Ecosystem

The COVID-19 pandemic badly impacted the global supply chains, and in India, it laid bare

the country’s dependencies on other countries for products. The lockdown measures announced by the central and state governments in 2020, brought the economy to a halt. These events underscored the need for a strong, indigenous manufacturing ecosystem.

As a response to this situation, the government announced Atmanirbhar Bharat Abhiyan (ABA) focused on five pillars: Economy, Infrastructure, System, Demography, and Demand.

These pillars are meant to make India self-reliant by reinforcing the virtuous cycle of indigenous manufacturing, employment creation, demand generation, and consumption. Under the umbrella of the ABA, the government launched Production Linked Incentives (PLI) to incentivize manufacturing, especially in those sectors and product categories that are not manufactured in India or have a limited manufacturing presence.

What is the Production Linked Incentive (PLI) Scheme?

The Production-Linked Incentive Scheme, or PLI incentivizes businesses for additional sales (over FY 2019-20) of goods produced in domestic facilities. While the initiative encourages international firms to establish units in India, it also encourages domestic firms to build new manufacturing units in India or expand existing ones.

Objectives of the PLI

- To stimulate domestic manufacturing by providing production incentives and encouraging both internal and external investment

- To recognize the importance of exports in the overall development plan but to concentrate efforts on the local markets

- To impose non-tariff measures that increase the cost of imports

- To safeguard some product categories

Which industries are covered under the PLI Scheme?

The scheme initially provided incentives to electronics manufacturers and pharmaceutical companies. The initiative has been extended to ten additional sectors, food processing, telecommunications, electronics, textiles, specialty steel, cars and auto components, solar photovoltaic modules, and white goods such as air conditioners and LEDs.

Impact of PLI Scheme on Major Manufacturing Sectors

Consider the following possible effects of the PLI plan on the following key industrial sectors:

- Automobile Industry – The Indian automotive sector has been allocated the highest financial expenditure of nearly INR 57,000 crores. Currently, the industry imports sophisticated auto components such as electric car components and injectors. The PLI program aims to incentivize car manufacturers to produce automobile components in India – and thus establish themselves as a worldwide exporter.

- Food processing- India is the world’s second largest vegetables and fruits producer, but only 2.2% undergoes processing. The government has planned an outlay of INR 10,900 crores. The packaged food market is estimated to be around USD 35 billion. The market is expected to double to USD 70 billion in the next five years with availability of a wider range of products for Indian consumers. 4, 5

- Steel- High grade specialty steel accounted for 60% of metal import, and the Indian steel industry operates at the lower stage of the value chain. In FY21, India produced only 18 million tonnes of specialty steel out of the total 102 million tonnes of metal production. WIth an outlay of Rs. 6322 through the PLI scheme, steel production is likely to double to 42 million tonnes by FY27. 6

- Electronics- Electronic manufacturers would get incentives ranging from 4% to 6% under this plan if they produce phones and other components in India, such as transistors, resistors, and diodes. Global manufacturers will get up to 6% in incentive payments if they build smartphones in India. The early signs are promising – just in five months of the scheme operation, by December 2020, applicant companies have invested INR 1300 crores and produced goods worth INR 35,000 crores. 7

Significance of PLI for Micro, Small and Medium Enterprises (MSMEs)

MSMEs are the second-biggest employer in the country. Currently, 56 million such businesses are operating in several sectors, employing over 124 million people. The MSME sector is considered India’s development engine. While large businesses generally constitute Original Equipment Manufacturers (OEMs) or producers, the MSMEs provide support in terms of manufacturing critical and ancillary products, components, and undertaking machine processes. Hence, typically, MSMEs benefit in terms of increase in orders and improved linkages when large enterprises setup or expand capacity. In the above context, the PLI has immense significance for MSMEs as PLI promotes an anchor-led model wherein OEMs can adopt import-substitution and collaborate with MSMEs, and integrate the latter into their global supply chain. This shall enable greater capacity utilization for MSMEs. Imports account for 21 per cent of India’s GDP. With import substitution opportunities, large manufacturers can expect savings worth USD 33.6 billion, and MSMEs can expect huge business opportunities3

MSMEs should adopt On-demand Manufacturing

While MSMEs will benefit from the opportunities arising out of the PLI scheme, their fragmented nature, lack of technical expertise, and managerial know-how can hurt their growth prospects. Additionally, MSMEs may not have the resources to set-up capacity or develop new products in-house in order to meet the requirements of an OEM partner.

In light of the above challenges, MSMEs can re-imagine their product development and production processes. Instead of pursuing a traditional approach, MSMEs should adopt on-demand manufacturing to develop new products, augment capacity, and build a supply chain. On-demand manufacturing addresses multiple pain points by simplifying RFQ creation, identifying the right vendor, material and process, and streamlining logistics.

The upsurge in industrial production as envisioned by the government will lead to an increase in demand for parts and require a strong vendor ecosystem. On-demand manufacturing platforms can play a critical role in strengthening the MSMEs overall capabilities, enable them to take large order sizes, and optimize costs.

If MSMEs and on-demand manufacturing platforms proactively explore collaborations while PLI’s trickle down effects reach fruition, MSMEs can leverage their on-demand manufacturing network on the go.

While the impact of PLI on large manufacturers and MSMEs is evident, a surprising beneficiary is likely to be on-demand manufacturing. Production Linked Incentives (PLI) can propel on-demand manufacturing into the mainstream, given the latter’s robust, practical use cases.

Reference links:

- https://www.pmindia.gov.in/en/major_initiatives/make-in-india/

- https://tradingeconomics.com/india/imports

- https://www.financialexpress.com/industry/sme/cafe-sme/msme-eodb-pli-scheme-to-nudge-oems-towards-local-sourcing-for-greater-made-in-india-capacity-utilization-of-msmes/2222274/

- https://www.business-standard.com/article/economy-policy/pli-for-food-processing-a-game-changer-to-boost-agri-exports-fmcg-players-121033101270_1.html

- https://thewire.in/economy/why-the-centres-pli-scheme-for-food-processing-sector-may-not-be-a-big-job-generator

- https://www.financialexpress.com/industry/cabinet-nod-specialty-steel-pli-caps-group-benefit-at-rs-200-crore-year/2295964/

- https://www.livemint.com/industry/manufacturing/mobile-makers-invest-1-300-cr-under-pli-scheme-in-2020-dec-qtr-govt-11617804132356.html

Karkhana.io – Your Ally for On-demand Manufacturing

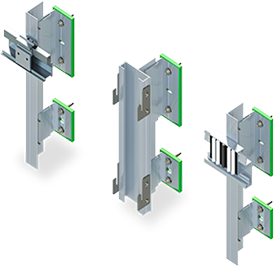

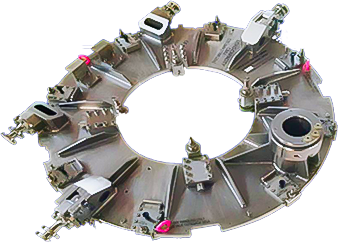

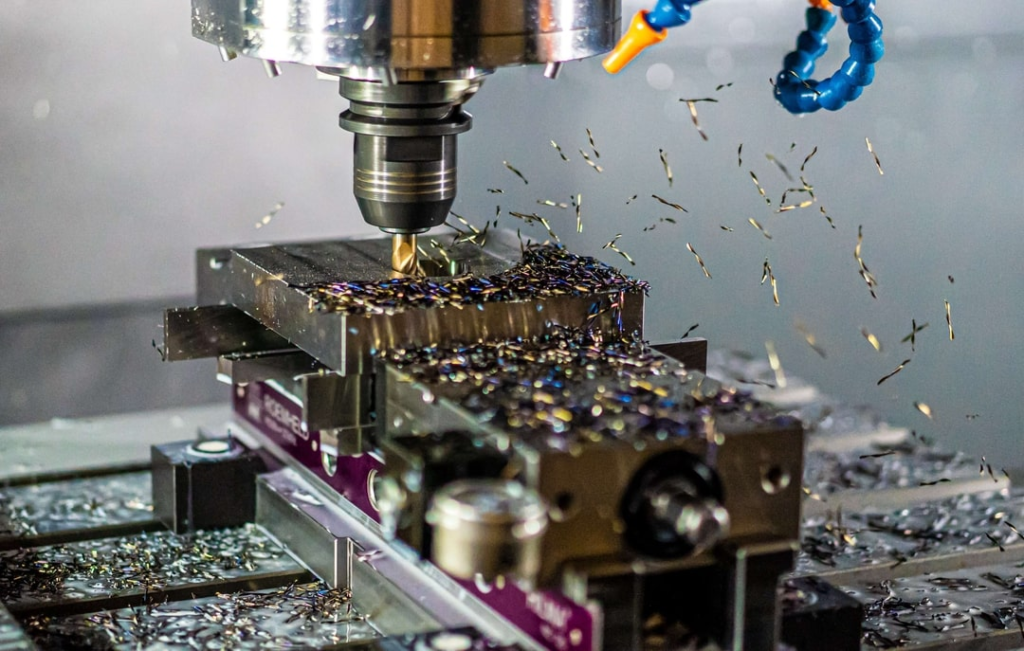

Karkhana.io is India’s foremost on-demand manufacturing company. We partner with start-ups, small & medium enterprises and large businesses, and address their prototyping and mass production requirements. We have a large number of trusted vendors with manufacturing capabilities spanning 3D printing services, vacuum casting, sheet metal fabrication, CNC machining, and injection molding.

We adhere to robust processes in terms of IP protection, materials & engineering, quality control and logistics. Karkhana.io takes the pain out of the vendor management process – ensuring a seamless experience for our customers.

Hence, if you are a start-up or MSME planning to launch a product but figuring out the manufacturing aspects of it, try Karkhana.io for your needs today.